The probate or estate settlement process can be a complex and emotionally draining journey. From identifying assets and beneficiaries to the distribution of property and inheritance, it is essential to understand the legal requirements and obligations involved clearly.

Among the various legal and financial considerations, probate fees can be complicated for many individuals. More importantly, you should familiarize yourself with the California probate cost structure if you are or will be serving as an administrator or executor of an estate. In this article, we will explore and simplify the intricacies of probate fees in California. Take your notes and effectively manage the probate process.

California Probate Costs

Credit: Image by JESHOOTS-com | Pixabay

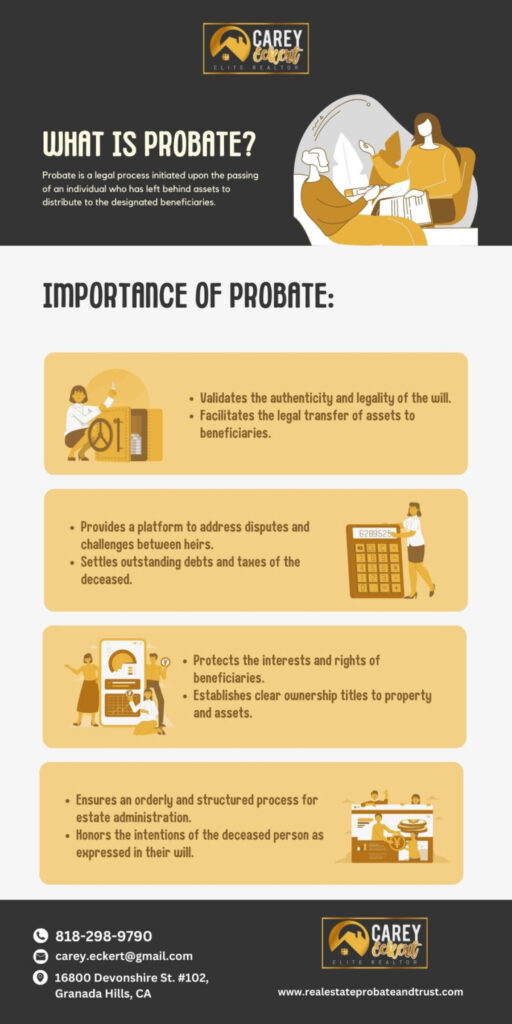

Probate is a court-administered procedure for distributing a deceased individual’s assets. The overall process incurs certain costs that may significantly impact the final distribution to beneficiaries. These costs form an integral part of the probate process. However, understanding the nitty-gritty details of probate fees can be complicated and challenging without proper guidance.

Since the cost of probate varies for each estate, it is important to consult with a qualified probate agent or attorney to determine the specific costs for your case. Factors such as the size and complexity of the estate, the type of assets involved, and any disputes or challenges can all impact the overall cost of probate.

Only legal experts with probate experience can provide a precise estimate. Typically, California probate fees consist of multiple components, such as compensation for the personal representative and their legal counsel, exceptional charges, and valuation fees.

Let’s learn more about these fees to help you prepare financially for the probate process.

Credit: Image by Marten Bjork | Unsplash

Fees for Probate Attorneys and Executor Commissions in California are calculated according to California Probate Code sections 10800 and 10810 and are tied directly to the estate’s total value. Per the regulations outlined in both sections, the attorney representing the personal representative will be entitled to compensation for their standard services.

The compensation will be calculated based on the total appraised value of the estate that has been accounted for by the personal representative and will be computed as follows:

| Probate Fee Percentage | Gross Value of Probate Estate |

|---|---|

| 4% on the first | $100,000 |

| 3% on the next | $100,000 |

| 2% on the next | $800,000 |

| 1% on the next | $9 million |

| 0.5% on the next | $15 million |

| Above $25 million | Court will decide |

Additionally, the court can grant supplementary compensation if the attorney has rendered exceptional services and charged a justifiable fee per the California Probate Code. Aside from the government-mandated compensation to be paid to the probate attorneys and executors, you should also prepare for other fees for filing petitions, applications for ex parte relief, and search for estate documents.

Better to check out the complete list of statewide civil fees in California to get a clearer idea of the total expenses you may incur during the probate process. Knowing these fees beforehand can help you budget accordingly and avoid surprises later.

California Probate Process

Credit: Image by Dose Media | Unsplash

The probate process in California typically comprises multiple steps. To help you familiarize yourself, here are the standard steps in a probate process. We also recommend consulting and seeking guidance from a legal professional to ensure a smooth and efficient estate administration.

| Step | PROCESS | |

|---|---|---|

| 1 | Initiation and Notification | To initiate probate proceedings and inform beneficiaries, a probate petition must be filed with the Superior Court in the decedent's place of residence. If there is a will, a copy of the original document must be included in the petition. The person named as the executor in the will becomes the estate representative, but if there is no will, a court-appointed administrator takes on this role. Important Note: Certain individuals, such as minors, non-US residents (unless named executor in the will), and those under conservatorship or unable to fulfill administrative responsibilities, are not eligible to serve as estate representatives to avoid conflicts of interest. Once the estate representative submits the probate petition, it is necessary to publish a notice in the local newspaper. This publication serves to notify beneficiaries and potential creditors about the upcoming probate process. |

| 2 | Court Hearing and Authorization Letters | After the initiation of probate, a series of court proceedings occur to ensure proper estate administration. These proceedings involve various tasks, such as verifying the sending of required notifications and identifying the deceased person's heirs. Important Note: Following the hearing, the court will issue a document known as the "letters testamentary" or "letter of administration." This document grants the estate representative the authority to act on behalf of the estate. They can then carry out tasks such as protecting the deceased person's property and assets. Essentially, the letters testamentary serve as official authorization for the estate representative to handle estate matters. |

| 3 | Identification and Valuation | After receiving the letter of administration or testamentary, the estate representative is responsible for preparing an inventory of the deceased person's assets subject to probate. Important Note: Not all assets the decedent owns will necessarily need to go through probate. For instance, assets like life insurance policies with designated beneficiaries may bypass probate. Apart from identifying the assets, the estate representative must also determine any outstanding debts the deceased owes. Once all subject assets have been identified, an independent appraiser will assess the value of each item on the inventory schedule. This appraisal helps establish the monetary worth of the assets within the estate. |

| 4 | Settlement | The decedent's legally enforceable debts must be paid off before any asset distribution can occur. Important Note: Creditors have four months to file their claims on the probate estate. After a creditor files a claim with the court, the estate's representative must either settle the debt if it is legitimate or file a counterclaim if there are reasonable grounds to do so. In addition to addressing debts, the estate representative must promptly pay all relevant taxes. It includes any outstanding income taxes, estate taxes, or other applicable tax obligations that may arise from the estate. It is important to fulfill these tax requirements to avoid any legal issues and ensure a proper estate settlement. |

| 5 | Distribution and Closure | After the settlement of all outstanding debts and taxes, the estate representative will formally petition the court to commence the probate closure process. Important Note: The petition includes a detailed account of all estate-related activities and a breakdown of any compensation due to the estate representative or attorney involved. Once the court reviews the accounting and no objections are raised, an order is issued to conclude the probate proceedings officially. Following the court's approval, the estate's remaining assets are distributed to the designated beneficiaries. This distribution ensures that the beneficiaries receive their allocated shares of the estate as specified in the will or according to intestacy laws if there is no valid will. By completing the distribution phase, the probate process comes to an end, and the estate administration is finalized. |

Conclusion

Probate is no doubt a complicated and lengthy process. It can take a few months to even years to complete, depending on the complexity of the estate or any disputes that may arise.

Seeking the assistance of an experienced probate professional can simplify the process. They can also give you a better understanding of the technicalities you may encounter and ensure that your estate is handled as efficiently and cost-effectively as possible. Staying organized, communicating with family members, and seeking support from loved ones throughout the process will significantly alleviate the burden of the probate process.

Ultimately, successfully settling an estate can provide closure and peace of mind for everyone. For more information about the California Probate Process, check out other blogs on our website to give you more profound and comprehensive insights.

Please don’t hesitate to contact us if you have any further questions or concerns regarding the California Probate Process. Take control of your probate journey today and secure your peace of mind. You may reach out to me via 818-298-9790 or carey.eckert@gmail.com. Contact us now to get started! Join our online community to keep updated on the latest news and happenings about California.

Credit: Image by Jess Bailey | Unsplash

Frequently Asked Questions

How do you calculate probate fees in California?

California probate fees encompass several costs and expenses.

One of which is compensation for estate representatives or attorneys. It is calculated based on the appraised gross value of the estate subject to probate.

Court fees, legal fees, executor fees, appraisal fees, and other expenditures may also be included in the total cost of probate.

Who pays for probate in California?

The deceased person’s estate assets typically cover probate fees in California. Expenses and any outstanding debts are paid first from the estate’s funds before giving anything to the beneficiaries.

What are CA Probate Code probate fees?

The California Probate Code sections 10800 and 10810 govern the probate fees. These sections outline the statutory costs that are applicable in probate proceedings.

Why is California probate so expensive?

Probate in California can be costly because of the state’s statutory fees, the complexity of the procedures involved, which sometimes necessitate legal representation, and the fact that lawyers are often recommended or required.

Preparing and consulting with an estate planning attorney can lessen these fees.