Estate planning involves the management of one’s estate following one’s death or incapacity. It comprises the distribution of assets to the heirs, the payment of estate taxes, and the coordination of burial arrangements.

The purpose of estate planning is to protect the interest of your loved ones and the value of your assets. This allows your family to grieve your loss and not have to fear the financial repercussions of fighting for the ownership of your investments.

Estate planning cost varies, and the difference in fees can add to the emotional challenges that come with managing matters of death. If you’re trying to navigate the basics of estate planning costs, this article provides the basic concepts that might help.

Credit: Image by Kampus Production | Pexels

Understanding Estate Planning Costs

The cost of estate planning varies depending on the unique needs of the estate. A basic will costs between $150 and $200. If you need a more complex plan, this may amount to $300 per hour.

There is no “one-size-fits-all” plan for an estate. The total cost of estate planning will depend on how many documents need to be prepared after the will, such as a power of attorney and the circumstances of the heirs.

Credit: Image by RDNE Stock project | Pexels

Factors Influencing Estate Planning Costs

Estate planning costs can vary significantly based on certain factors that influence the individual circumstances and needs of the person planning their estate, including:

Complexity of the Estate

The more complex the estate is, the more time and resources are needed to plan its distribution.

Size of the Estated

Generally, the larger the estate, the more costly it will be to plan for its distribution. With more assets, more paperwork and legal procedures will be required.

Location of the Estate

Estate planning costs can also be affected by the location of the assets. Planning for the distribution of assets located in multiple states or countries, for instance, may cost more.

Type of Documents Needed

Documents needed for estate planning can also affect the cost. A trust may be more expensive than a simple will.

Lawyer’s Fees

Lawyer’s fees vary depending on their experience, location, and other factors.

Credit: Image by Andrea Piacquadio | Pexels

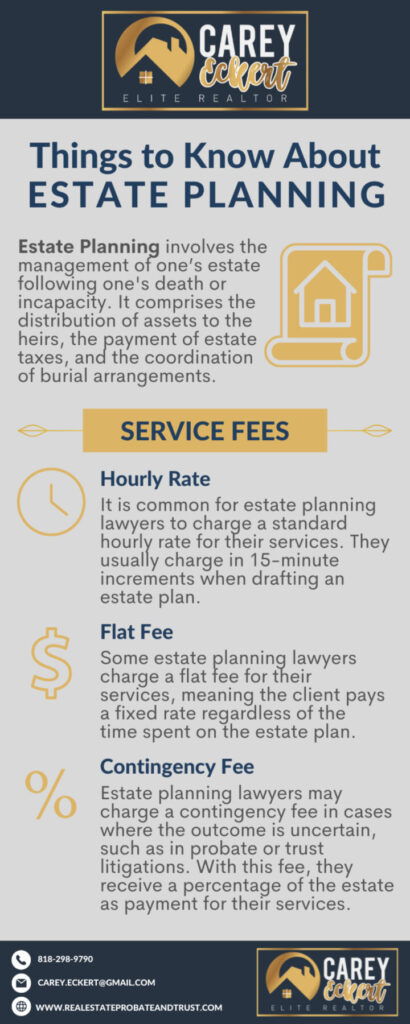

Exploring Service Fees

The types of fees involved when engaging in estate planning services vary depending on the complexity of the estate and the services provided.

Hourly Rate

It is common for estate planning lawyers to charge a standard hourly rate for their services. They usually charge in 15-minute increments when drafting an estate plan.

Flat Fee

Some estate planning lawyers charge a flat fee for their services, meaning the client pays a fixed rate regardless of the time spent on the estate plan.

Contingency Fee

Estate planning lawyers may charge a contingency fee in cases where the outcome is uncertain, such as in probate or trust litigations. With this fee, they receive a percentage of the estate as payment for their services.

Because estate planning isn’t adversarial, estate planning attorneys typically do not use contingency fees. However, probate attorneys might charge a form of contingency fee to help you settle an estate.

Credit: Image by Kampus Production | Pexels

Additional Expenses to Consider

Aside from lawyer’s fees, the following are costs you will have to factor into your overall estate planning expenses.

Wills and Trusts

A will is a legal document that stipulates how you want your assets to be distributed after you pass away. Depending on the state and the lawyer’s fee structure, the typical cost of drafting a will is $500.

A trust is a legal arrangement transferring ownership of your assets to a trustee, who will manage the assets for the benefit of the trust’s beneficiaries. Trusts are often costly, and a lawyer will typically charge around $2,000 to draft a trust.

Durable Power of Attorney

A general durable power of attorney permits a person to act in a wide range of legal and business concerns. It continues in effect even if you become incapacitated.

The typical cost for drafting a durable power of attorney is $375. Keep in mind that this varies by state.

Healthcare Power of Attorney

A healthcare power of attorney is helpful in case a medical emergency renders you unconscious or unable to make decisions regarding your care. This appoints a person to speak with doctors and make medical choices on your behalf.

Hiring a lawyer to prepare your health care advance directive can cost between $250 and $300 per hour.

Letter of Intent

A letter of intent, also called a personal directive or living will, is a document that outlines your preferences for medical treatment and end-of-life care.

This document is typically not legally binding but can serve as a guide for your healthcare power of attorney and other loved ones. A business lawyer’s hourly charge for drafting a letter of intent ranges from $200 to $350.

Credit: Image by Vlada Karpovich | Pexels

Cost-Effective Strategies

Depending on your situation, estate planning can be unpredictable and costly. Here are ways to help minimize the costs.

Choose the Right Lawyer

When looking for lawyers specializing in estate planning, check online and compare their reviews. A licensed attorney who specializes in end-of-life planning can handle your case efficiently, which could result in lower fees.

Prepare Ahead

Gather important documents, including deeds, titles, insurance policies, and financial statements. This can help you save time and money as you make it easier for your lawyer to understand your estate and develop a plan.

Discuss the Costs Upfront

It is important to clearly understand the costs associated with estate planning from the start. Ask about your lawyer’s fees and other costs that may be incurred, such as appraisal fees or tax preparation fees.

Request a Quote and Negotiate

If you are not satisfied with the fees quoted by one lawyer, consider requesting quotes from multiple lawyers. You can lower fees by negotiating for a flat fee or a lower hourly rate.

Have a Written Agreement

It is essential to have a written agreement with your lawyer that outlines the terms of the representation and the costs associated with the estate planning process.

Credit: Image by Alena Darmel | Pexels

Investing in Peace of Mind

The process of distributing your assets can take as long as a year. However, with estate planning, you can make sure that your heirs don’t experience this inconvenience.

If you’d like to learn more about the importance of estate planning, please contact me at 818-298-9790 or carey.eckert@gmail.com to schedule an appointment.

Frequently Asked Questions

What happens if I don't plan my estate?

If you fail to create an estate plan, you’re essentially leaving everything up to the courts. After you pass away, a court will step in to appoint the appropriate people to handle your estate.

What is included in estate planning costs?

Estate planning costs include financial advisor fees, estate planning lawyer fees, trustee fees, filing fees, appraisal fees, executor fees, and tax planning fees.

Can I reduce estate planning costs?

Consider requesting quotes from multiple lawyers and choose the one with the lowest fees. You can also negotiate for a flat fee or a lower hourly rate.