Life is a rollercoaster journey, and sometimes, managing our assets, such as property or finances, becomes challenging. But don’t worry! A legal document called power of attorney for property can help you manage your assets when you are unable to.

But what exactly is it? This article breaks down what you need to know about the power of attorney regarding your property so you can better understand its importance and limitations.

Definition and Purpose

Credit: Image by Oleksandr Pidvalnyi | Pixabay

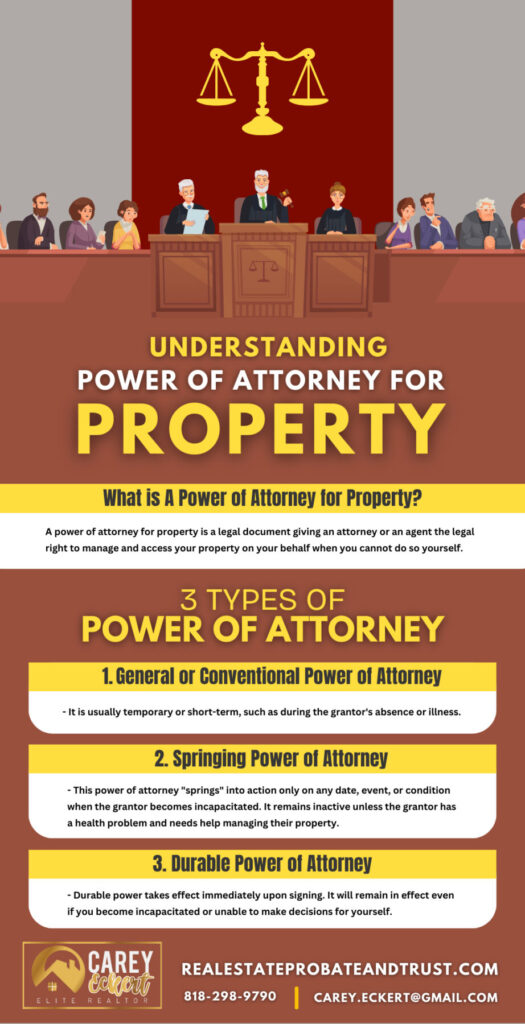

What is Power of Attorney for Property

In California, a power of attorney for property is a legal document giving an attorney or an agent the legal right to manage and access your property on your behalf when you cannot do so yourself.

In creating a power of attorney for property, you are called the “principal,” and the person you will appoint to manage your property is called the “agent” or the “attorney-in-fact.”

Importance and Benefits

Power of attorney for property is a practical solution for individuals facing geographical limitations or health-related issues.

The appointed agents have the legal authority to manage complicated property affairs and documentation, upholding the integrity of property transactions for the principal’s best interest.

Power of attorney can:

- Protect the principal against potential disputes

- Handle banking matters

- Manage investments

- Buy and sell real estate

- Pay monthly bills

The only thing your appointed attorney can’t do is write your will. Although the person you give this power to is your attorney, it does not mean they are your lawyer.

Credit: Image by Nattanan Kanchanaprat | Pixabay

3 Types of Power of Attorney

There are 3 types of power of attorney for property in California. When choosing a power of attorney for a property that best suits your needs and circumstances, you must carefully consider your options and consult a legal professional.

This allows the agent or attorney to make personal decisions about the property on behalf of the grantor, such as buying or selling property and handling real estate investments.

The general or conventional power of attorney is usually temporary or short-term, such as during the grantor’s absence or illness.

Because responsibility is limited, this is also known as Limited Power of Attorney.

This power of attorney “springs” into action only on any date, event, or condition when the grantor becomes incapacitated. So, it remains inactive unless the grantor has a health problem and needs help managing their property.

It is essential to carefully word the drafting of a springing power of attorney to define the conditions clearly.

You should consult with an experienced professional in estate planning and California laws to ensure that the power of attorney accurately reflects your wishes and provides the necessary protection.

Unlike springing power of attorney, which takes effect only under specific circumstances, durable power takes effect immediately upon signing. It will remain in effect even if you become incapacitated or unable to make decisions for yourself.

The agent can make decisions regarding your properties if you become incapacitated caused by an illness, injury, or other reasons. A durable power of attorney provides added protection and continuity, ensuring that someone can step in and handle your affairs when you need it most.

Obligations and Limitations

Credit: Image by Aymanejed | Pixabay

What your attorney can do depends entirely on how much power you give them, as you state in the document.

You could provide a general power of attorney for a property that gives them legal authority to manage your property and financial affairs. Or, you could give a more specific authority to handle only some of your assets.

For example, you could limit a power of attorney to a single real estate transaction while out of the country.

You must clearly state what you allow your attorney to do and not, whether you want a power of attorney to take effect in the future or upon a specific occurrence only.

For example, most people wish to prepare a power of attorney when they can’t manage their assets anymore as they age.

Depending on the type, if you do not limit the Power of Attorney, it will continue to have an effect until your death. You may also hear a power of attorney called a continuing power of attorney for property. In contrast, authority will continue to have an effect even if you become mentally incompetent.

Creating a Power of Attorney

Credit: Image by Edar | Pixabay

You must follow the following rules to give a power of attorney for property and appoint your attorney. You must be:

- 18 years old and above

- Mentally capable

- Aware of the property you own and how much it’s generally worth

- Aware of what it means to appoint an attorney and the authority you are giving your attorney,

- Aware of the possibility that the attorney might use the authority you give.

Your attorney must be 18 years of age or older and mentally competent. Although it may be best to appoint someone with knowledge of financial matters, you should select someone you know well and trust.

Often, people appoint someone close to them, like their spouse, relative, or friend.

Choosing the Right Agent

Credit: Image by 089photoshootings | Pixabay

Before appointing an attorney to manage your property or finances, determine the purpose and scope of the power you want to give, including managing property, sales, leasing, mortgagees, or other property-related activities.

The crucial step is to select an agent/attorney-in-fact. Choosing an agent should be based on trust, reliability, and the agent’s ability to execute the responsibilities effectively.

You can appoint more than one attorney and name an alternate attorney who would step in if the primary attorney is unable to act for some reason.

Suppose you are uncomfortable selecting a family member or friend as your attorney. In that case, consider selecting a trust company to be your attorney for financial matters. Often, people choose to trust companies because they are professional and unbiased.

Steps to Draft

Credit: Image by StartupStockPhotos | Pixabay

The first step in creating a power of attorney is drafting it. The document of power of attorney for property generally comprises several essential sections.

- The introduction provides context, identifying the grantor and the agent.

- The background outlines the reasons for creating the document.

- The ‘powers and responsibilities’ section outlines the precise actions the agent is authorized or allowed to undertake on the grantor’s behalf, specifying the scope of authority, duration of the document’s validity, and the condition under which it may be terminated.

After drafting a power of attorney:

- Review and revise it as necessary.

- Ensure the language is clear and reflects your intent as the grantor.

- Correct any unclear parts or discrepancies during this phase to prevent potential problems.

You can check this Sample Document for reference and guidance in drafting a power of attorney.

Witnesses and Notarization

Credit: Image by bertholdbrodersen | Pixabay

The document of power of attorney requires signatures from the grantor and agent upon finalizing the content. The signatures must be executed in the presence of the witness to be legal, and depending on the jurisdiction, they need to be notarized by a notary public to verify authenticity.

Witnesses validate the grantor’s voluntary and sound state of mind during the power of attorney’s execution, while a ”notary public” seal adds an official layer of authenticity.

Witness and notary strengthen the attorney’s legal standing, affirming the grantor’s intent and protecting against potential conflicts.

Per the law, some people can’t be your witnesses, such as the attorney you appoint, the attorney’s spouse or partner, your spouse or partner, your child, or any person under 18.

Revocation and Termination

Credit: Image by advogadoaguilar | Pixabay

Appointing someone for power of attorney to help you decide about your finances or property when you can’t is a big decision. But sometimes relationships and trust change, and what felt right before may not feel right now.

It is natural to change your mind, and the law recognizes that. However, the important thing to remember is to handle this change lawfully and clearly.

How to Revoke a Power of Attorney

In California, state law governs the termination of a Power of Attorney, specifically California Probate Code sections 4000-4545. These statutes state that a Power of Attorney may be revoked by creating a separate revocation document or by executing a new POA that expressly revokes the previous one.

Whichever method you choose, it is important that the revocation clearly states your reason for revoking a power of attorney.

Depending on the situation, revoking a Power of Attorney can take a few days, but it can take longer in some cases. The process starts with drafting the revocation document, notarizing it, and sending it to the involved parties.

According to California law, the revocation must be recognized by a notary public. After the revocation document is notarized, you should give a copy to your former agent and other parties who dealt with your agent while the original power of attorney was in effect.

If the original power of attorney was filed with a County Recorder’s Office, the revocation should also be filed there, which takes longer to process.

The agent cannot cancel a power of attorney, but they can resign. If an agent chooses to quit, they must give written notice to the principal, any co-agents, and third parties they have interacted with while power of attorney is in effect.

Grounds for Termination

Credit: Image by advogadoaguilar | Pixabay

Various circumstances can justify terminating a power of attorney for property in California. Maybe the agent is resigning or becoming incapacitated and isn’t the right fit anymore, or the agent has completed the specified tasks outlined in the power of attorney document.

Maybe you no longer trust that person to handle your stuff like you want, perhaps you’ve picked someone else for the job, or your life situation has changed.

Under California Probate Code [4000-4545], the authority granted to an attorney-in-fact through a power of attorney ceases under various circumstances:

- If the power of attorney document explicitly states termination conditions.

- When the subject or purpose of the power of attorney no longer exists.

- Upon revocation of the attorney-in-fact’s authority.

- Upon the principal’s death, unless certain authority is legally permitted after death.

- If the attorney-in-fact is removed or resigns.

- In case of the attorney-in-fact’s incapacity, with the exception of temporary incapacity which only suspends authority during the incapacity.

- Upon the dissolution or annulment of the marriage between the attorney-in-fact and principal, as outlined in Section 4154.

- Upon the attorney-in-fact’s death.

Conclusion

The power of attorney for property is a crucial legal tool, offering individuals practical solutions for managing their assets during incapacity or limitation.

Understanding its types, importance, and limitations is essential for informed property management and financial affairs decisions. Furthermore, by carefully selecting the right agent and following proper drafting and execution procedures, individuals can ensure effective and secure property management in line with their wishes.

Having a power of attorney for the property will help you navigate life’s uncertainties confidently. You can be assured that your property and finances are safe and will be managed when you cannot.

If you want to understand more about the power of attorney for property or have questions, don’t hesitate to contact us by calling 818-298-9790 or emailing carey.eckert@gmail.com, and we will be glad to help you. You can also visit our page should you want to learn or need Probate, Trust, or Conservatorship assistance.

Feel free to join us on social media to stay informed about the latest happenings in California.

Credit: Image by Gerd Altmann | Pixabay

Frequently Asked Questions

What is a power of attorney for property?

It is a legal document that allows you to give an attorney or an agent the legal right to manage and access your property on your behalf when you cannot do so yourself.

How does it differ from other types of POA?

Different decisions require power of attorney, like business matters or medical care. A power of attorney for property authorizes the agent authority to handle financial matters and property-related decisions.

Can a power of attorney for the property be revoked?

Yes, the person who granted it can revoke a power of attorney for property as long as the principal is mentally competent. The principal can sign a revocation document to cancel it and notify all relevant parties, such as the attorney-in-fact.

What happens if there's no power of attorney in place?

Legal authority is handy if you cannot decide about your property or finances. Not having a power of attorney for property can lead to complications.

The court may appoint a guardian or conservator to manage your property or financial matters, which can be time-consuming and costly and may not align with your preferences.

Having a power of attorney for property creates a smoother transition of authority and ensures that your wishes are followed.

Can a power of attorney for property override a will?

A power of attorney for property allows the appointed agent to manage financial matters on behalf of the principal while incapacitated but not overriding the instructions laid out in a will. Once the principal passes away, the will governs how their assets will be distributed.

The executor mentioned in the will is responsible for carrying out the deceased person’s wishes according to the terms of the will.